How california mortgage brokers Can Simplify Your Home Buying Experience

Recognizing the Role of Mortgage Brokers in Securing Your Dream Home

Browsing the elaborate landscape of home financing can be complicated, however understanding the essential duty of home loan brokers supplies quality and guidance. By using and assessing monetary circumstances customized suggestions, home loan brokers can open a wide variety of loan alternatives that may or else remain hard to reach. What are the details advantages of getting a home mortgage broker, and exactly how can you ensure you pick the best one to secure your dream home?

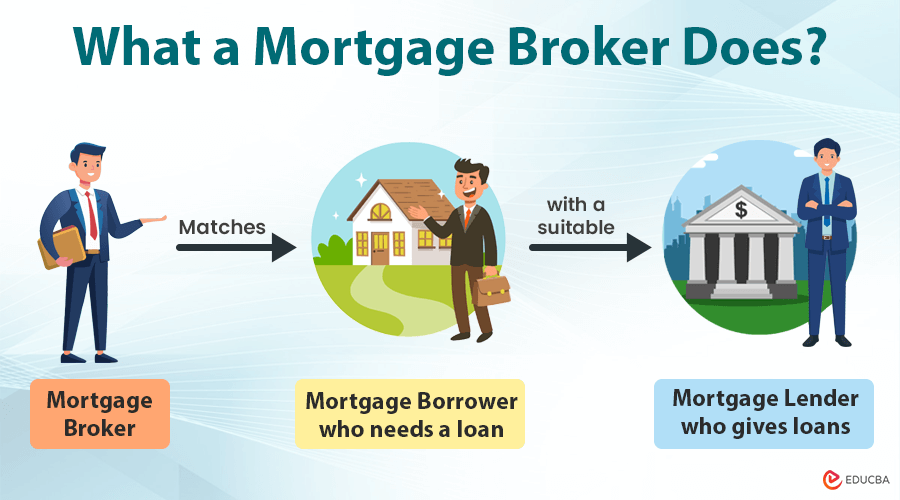

What Home Loan Brokers Do

A mortgage broker works as an intermediary between consumers and lending institutions, aiding prospective property owners safe financing for their desire homes. They play an essential duty in the home-buying process by leveraging their expertise and sector knowledge to attach clients with one of the most suitable home loan items. Unlike direct lending institutions, home loan brokers have access to a large array of funding choices from different economic establishments, allowing them to tailor options to the specific requirements and monetary circumstances of their clients.

Home mortgage brokers start by examining a customer's financial circumstance, consisting of earnings, credit rating, and overall monetary health and wellness, to identify the finest possible lending alternatives. They then research study and examine various home mortgage items, providing a range of alternatives that line up with the consumer's constraints and objectives. Throughout this procedure, brokers give valuable insights right into the intricacies of mortgage terms, rates of interest, and finance structures.

Additionally, home loan brokers help with the prep work and entry of car loan applications, ensuring that all required documents is exact and total. Their meticulous focus to information decreases the likelihood of hold-ups or errors that could hamper the authorization process. Inevitably, home loan brokers streamline the course to homeownership by simplifying intricate economic purchases and supplying personalized support.

Advantages of Working With a Broker

Involving the services of a mortgage broker uses countless advantages that can substantially improve the home-buying experience. Home mortgage brokers have developed relationships with multiple lending institutions, allowing them to present a range of loan choices tailored to fit the unique financial situations of their customers.

In addition, mortgage brokers can save possible home owners valuable time and effort. They deal with the elaborate paperwork, bargain terms, and streamline the application process, allowing customers to focus on various other facets of home purchase. Their knowledge in the mortgage industry also equates to seem advice, helping customers navigate complicated financing criteria and select the most appropriate funding solution.

Another substantial benefit is the tailored service home mortgage brokers offer. They work very closely with clients to understand their monetary objectives and restrictions, ensuring that the home loan lines up with lasting objectives. In enhancement, brokers usually have the ability to discuss much better terms as a result of their sector understanding and partnerships, better improving the worth they give the home-buying procedure.

Just How to Pick a Broker

Selecting the ideal mortgage broker is a crucial step in protecting your desire home. The procedure starts with research; gathering info concerning potential brokers is vital.

Once you have a shortlist, verify their qualifications. Guarantee they are qualified and registered with relevant regulatory bodies. An expert who holds qualifications from identified institutions demonstrates commitment to their craft. It's also vital to review their interaction abilities. A reliable broker should be able to explain complicated financial terms clearly and be receptive to your inquiries.

Throughout preliminary page examinations, examine their understanding of your needs. A qualified broker will certainly inquire about your economic circumstance, goals, and preferences to tailor their solutions to you. In addition, compare their fee structures to stay clear of unexpected costs. Openness about costs and payments is a trademark of professionalism. Ultimately, count on your instincts; a broker that motivates self-confidence and demonstrates stability will be a useful companion in your home-buying trip.

Funding Options Offered

When starting the trip to purchase your desire home, understanding the array of funding choices available is essential. The mortgage landscape provides a range of products, each dealing with different economic scenarios and preferences. Traditional car loans, commonly favored for their affordable interest rates, are ideal for debtors with solid credit rating and a considerable deposit. These lendings are not pop over here guaranteed by the federal government, unlike FHA fundings, which are made for those with lower credit rating and minimal deposits, making homeownership a lot more accessible. california mortgage brokers.

VA lendings, unique to experts and active military participants, offer favorable terms, consisting of no deposit and no private mortgage insurance policy (PMI), representing a significant benefit for qualified people. USDA financings accommodate country and rural buyers, supplying zero down settlement options for those meeting certain earnings criteria. For those looking for adaptability, adjustable-rate home loans (ARMs) include lower preliminary rates of interest that readjust in time, straightening with market conditions.

Jumbo loans are customized for high-value residential property purchases going beyond standard car loan limitations, requiring more powerful economic qualifications. Reverse home mortgages, readily available to elders, permit taking advantage of home equity without month-to-month payments. Each alternative provides one-of-a-kind advantages and factors to consider, making it possible for borrowers to align their option with economic objectives and circumstances.

Tips for Working With Brokers

Navigating the procedure of acquiring a home can be overwhelming, and working with a knowledgeable home mortgage broker can be an invaluable asset in enhancing this journey. To take full advantage of the benefits of this collaboration, it is critical to come close to the connection with clear expectations and efficient communication. Beginning by clearly specifying your monetary objectives and restrictions, so your broker can customize their search for ideal mortgage items. Transparency regarding your monetary circumstance will allow the broker to present sensible options.

Conduct complete study to guarantee you are working with a trusted broker. Validate their credentials, read reviews, and look for suggestions from trusted sources. This persistance guarantees you are collaborating with an expert that has a tried and tested performance history of success.

Communication is key; maintain normal call and immediately react to ask for documents or read this info. This collaborative initiative will accelerate the process and permit the broker to act swiftly on your part.

Verdict

The function of mortgage brokers is essential in browsing the intricacies of home financing. By serving as middlemans, they supply experienced advice, access to varied lending choices, and the capacity to work out desirable terms. The advantages of employing a broker reach tailored economic remedies that align with private needs. Choosing a certified broker and successfully collaborating with them can dramatically improve the home buying experience, making certain a smoother path to safeguarding the perfect home loan.

By supplying and assessing financial situations tailored guidance, mortgage brokers can open a wide variety of car loan choices that may otherwise continue to be inaccessible. Unlike straight lenders, home loan brokers have accessibility to a wide selection of loan alternatives from different economic organizations, allowing them to tailor choices to the specific requirements and financial scenarios of their clients.

Mortgage brokers have actually established partnerships with multiple lending institutions, enabling them to offer a selection of financing choices customized to fit the unique monetary situations of their clients.